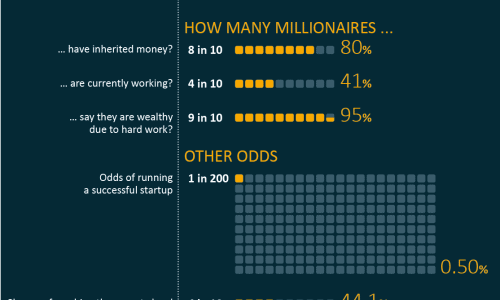

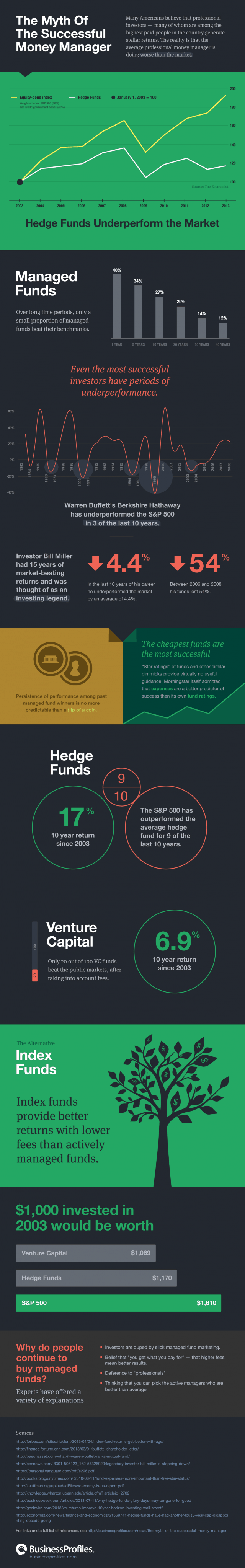

There is no such thing as a fail-proof investment, no matter who’s looking after your money. Some of the best investors of our time (Warren Buffet, Bill Miller) have lost large amounts of money over under-performing businesses and investments within the last 10 years. Hiring a professional investor may seem like a smart move, but according to today’s infographic, “the average professional money manager is doing worse than the market.”

Buffet’s company Berkshire Hathaway has slipped recently with its expected performance in the market. And between 2006 and 2008 Bill Miller’s funds lost 54%. It seems that hiring a money manager for investments might just be a poor investment in itself.

It should also be noted that the cheapest funds are actually the most successful. “Star ratings” of funds and similar tactics don’t provide much guidance. “Persistence of performance among past managed fund winners is no more predictable than a flip of a coin.”

With this in mind, if you’re thinking about future investments, you might just be better off doing your own research and using your intuition. You may have to spend money to make money, but it may be wise to keep your money out of the hands of so-called “professionals.” [Business Profiles]