‘Cause if you want to make your woman happy, it had better be huge. I mean, the average wedding in the United States will run you about $29,858. But if it’s traditional and her parents are paying for it, then I guess we can just round that number up to $30,000, and you can pocket the extra $142. JK, that’s unethical.

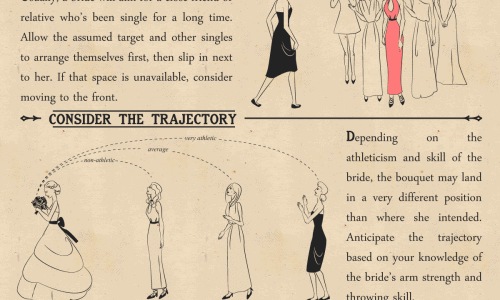

Seriously though folks, a wedding can be super expensive. With the cost of the venue averaging around $13,000, as well as the music and photos getting close to another $6,000, your wedding will most likely be the most expensive day of your life. Which it probably should be. Marriage is no joke. I’m a bit traditional in the sense that I believe when you get married, you stay married. So, if you want it to count, it might be worth your time to lay down the cash. But it might be smart to make sure your wedding is covered in case Granny breaks a limb cuttin’ footloose to Skrillex just before the cake never shows up, and Dad can’t stand the man you’re marrying and rallies up the extended cousins and uncles to make a mess of that rental tux your groom is sporting, all while your honeymoon flight has been cancelled on account of terrorists.

Wedding insurance can save you. It may not be able to save your doomed marriage in the case of the aforementioned busted Granny/busted groom scenario, but hey, at least you can walk away with some of that cash back in your pocket. How ironic would it be if you were only reimbursed $142?

The WedSafe program is brought to you by Aon plc (NYSE:AON), the leading global provider of risk management, insurance and reinsurance brokerage, and human resources solutions and outsourcing services. [WedSafe]