For freelancers, entrepreneurs and small business owners, financial statements can be bothersome and even daunting, but it’s one of those things we just *have* to do.

When you’re trying to figure out your freelance rate or the appropriate fees to charge, you probably should know how much your business is actually making and whether it’s profitable. Today’s infographic is a visual guide to the financial side of the business, so you can be more knowledgeable when your accountant comes asking for numbers.

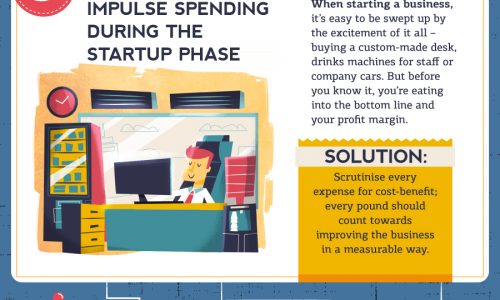

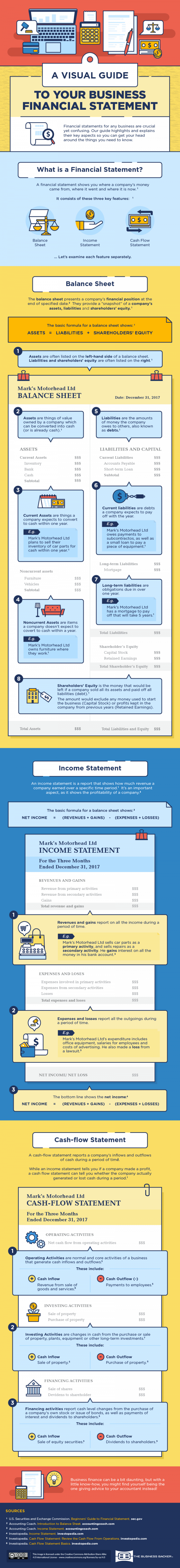

Financial statements basically show where a business’s money comes from (income), where it goes (expenses) and where it is now (cash flow). These three features are shown through a balance sheet, an income statement and a cash flow statement.

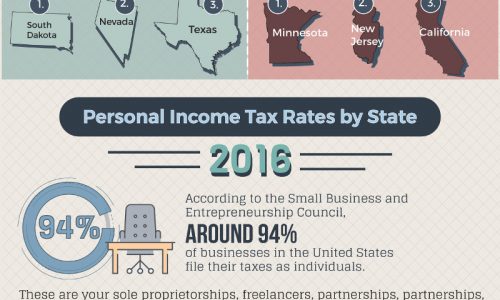

One key purpose of financial statements is to give a clear outline of your income and expenses so your taxes can be calculated with your actual income. The federal government and your local tax authority need to take a cut, so make sure your numbers are well accounted for. It’s also advisable to keep relevant receipts for a few years.

Some people’s eyes glaze over when trying to look at financial statements, but once you understand them better, they’ll become a little less tedious. You’ll be a paperwork pro in no time.