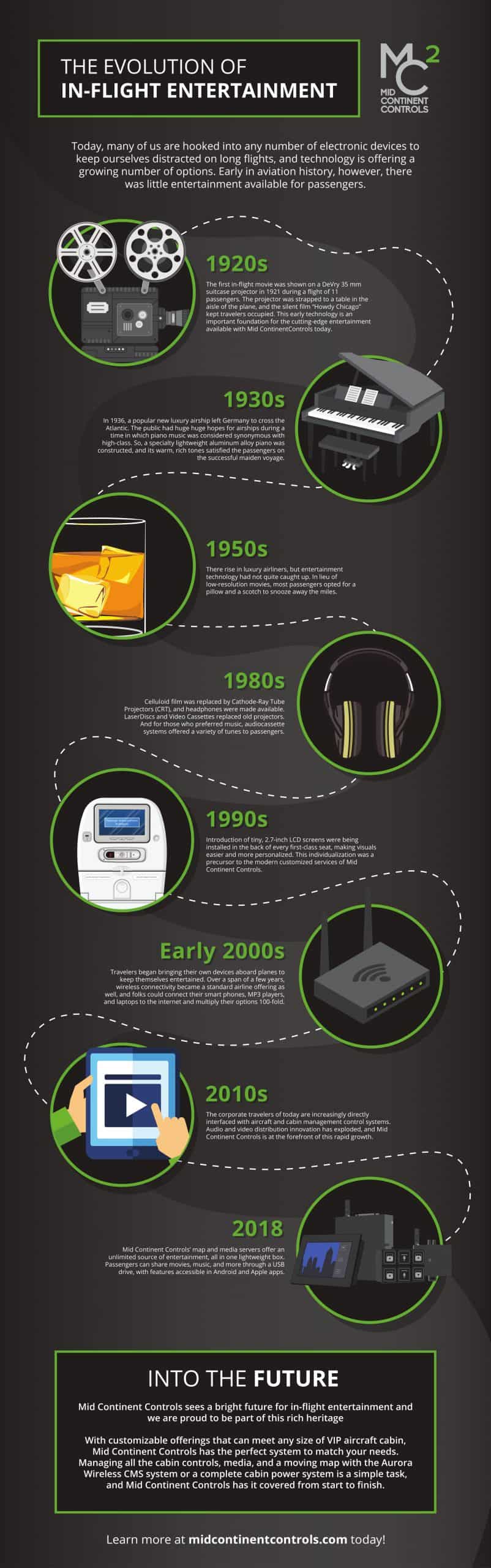

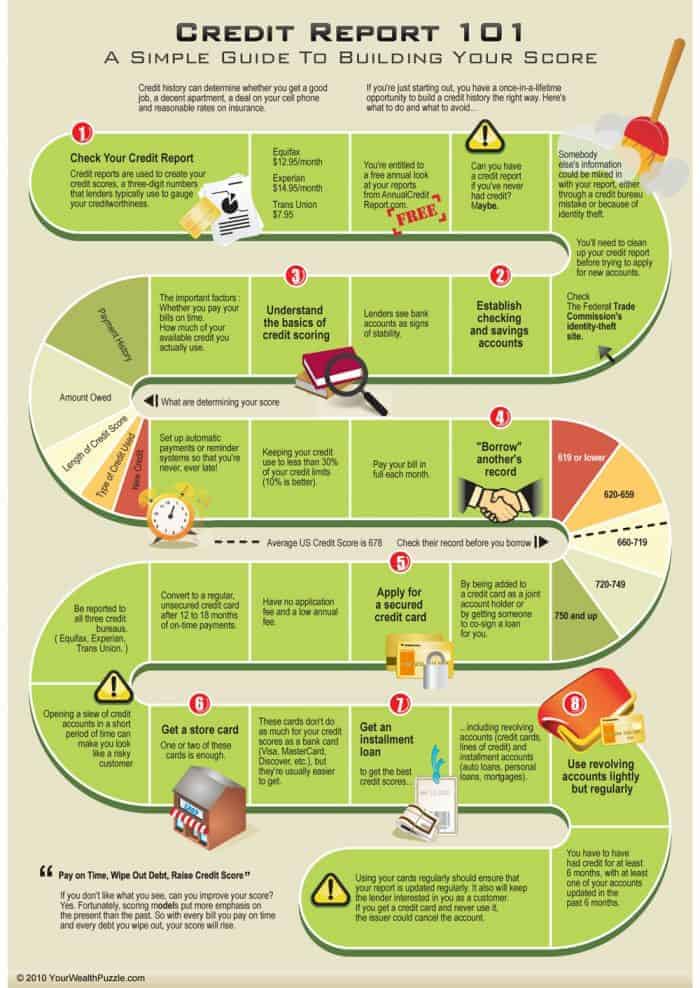

I hope you all enjoyed my last infographic, and the little story that came with it. Still being in college, with loans, and remaining a dependent of my parents I have little to no credit. However, I know that soon enough I will need to start building up my credit if want any chance at having any sort of affordable interest rates in the future. In today’s world, credit rules the market place, even though it is at fault for our financial crisis. Even with this credit remains our form of currency and we must know how to handle it.

If you’re like me, the extent of your credit score knowledge is not very large. I know that credit companies don’t like it when someone has good credit, because it means they won’t be making much money off them. I also know that making payments on time allows you to maintain a good credit score. Unfortunately, this is as far as my knowledge on credit score goes.

I’m not clueless when it comes to the economy, in fact I know quite a bit about it. However one of the aspects that effects me the most, personal finance, I know almost nothing about. Thankfully, we have the internet and its infinite amount of information. The following infographic provides us with a board-like layout on how to keep a good credit score. Starting with obtaining a credit report, to how to keep it up, as well as remaining interesting to lenders, this infographic leads you through the steps. Hopefully this infographic is as informative for you as it was for me. [via]

Click to enlarge