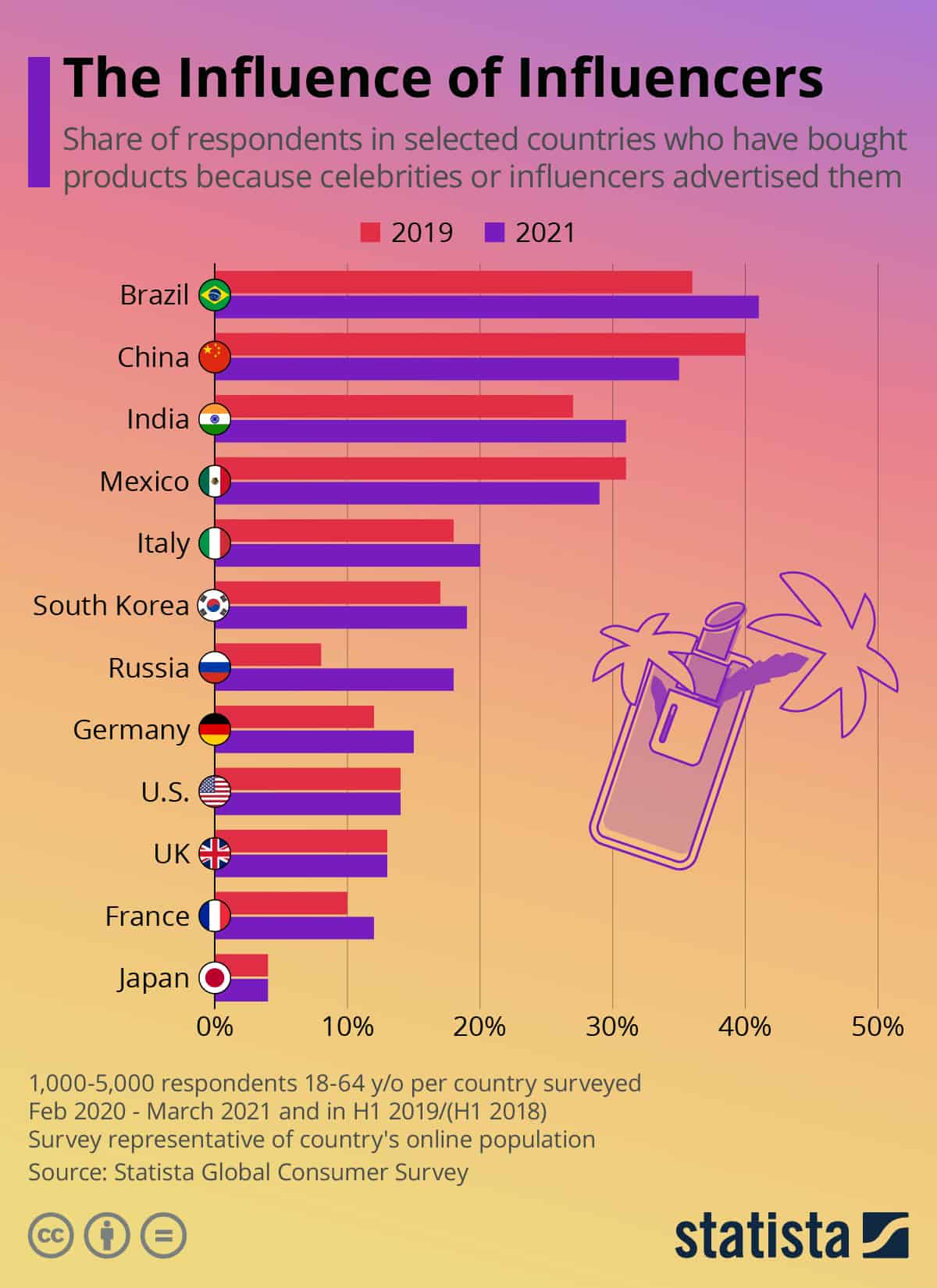

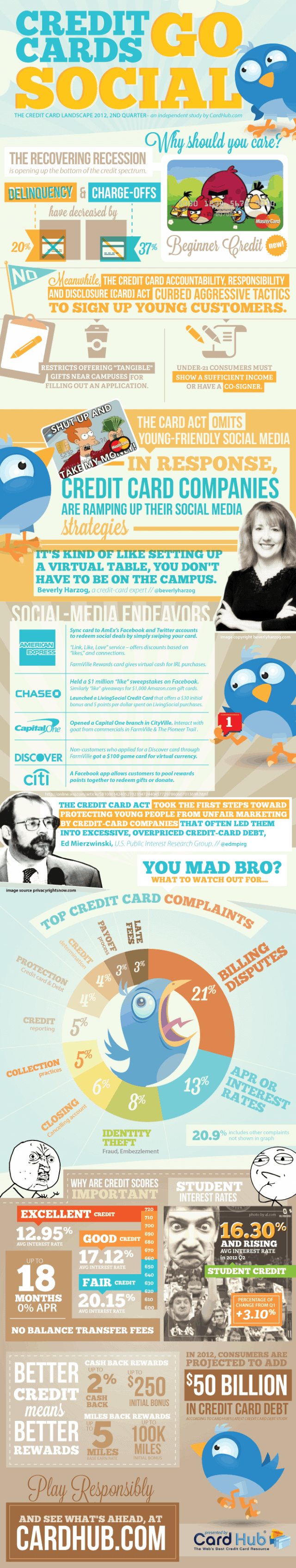

I have been told over and over again by parents, teachers and friends to never get a credit card until I have sufficient income. Unfortunately not everyone my age has been informed of that. Recent legislature has curbed aggressive marketing tactics on university campuses, but now with social media options, it seems like there are marketers inside our homes.

Credit scores are incredibly important. When a student gets a credit card they cannot afford it can ruin their borrowing ability for decades to come. Students always need education on personal finance and I think we are doing better now than ever before.

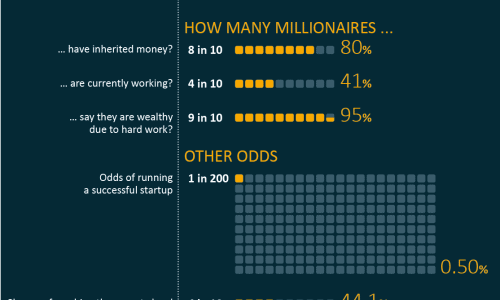

An estimated fifty billion dollars worth of credit card debt will take place in 2012. Even though the number is high, delinquency and charge-offs have both declined by over 20%. Just like our slow climb out of the recession, bad credit will slowly decrease as more individuals are educated. [CardHub]