Save even more money, without suffering in the process. Here are some clever ways to save extra money every month.

So you want to start saving more. That’s great! The first step is making a budget. In order to achieve this, look closely at your income and your spending. Grab a notebook or make a spreadsheet and write it all down; everything you receive per month and your expenses. To make this easier (especially when it comes to listing your expenses) start by the usual payments you need to make: rent, taxes, mortgage, subscriptions… In order to make sure everything is right, check your accounts and look at last month’s movements. That should give you a close idea of your usual spending habits.

Then, jot down coming expenses that fall outside your “normal” spending. This means birthday presents, holiday shopping, a wedding, a trip, or even a season where you know you’ll be eating out more (ie. finals week!). Now comes the fun part: calculate your monthly expenses and your total income. Deduct your expenses from your income, and you’ll be left with your pocket money.

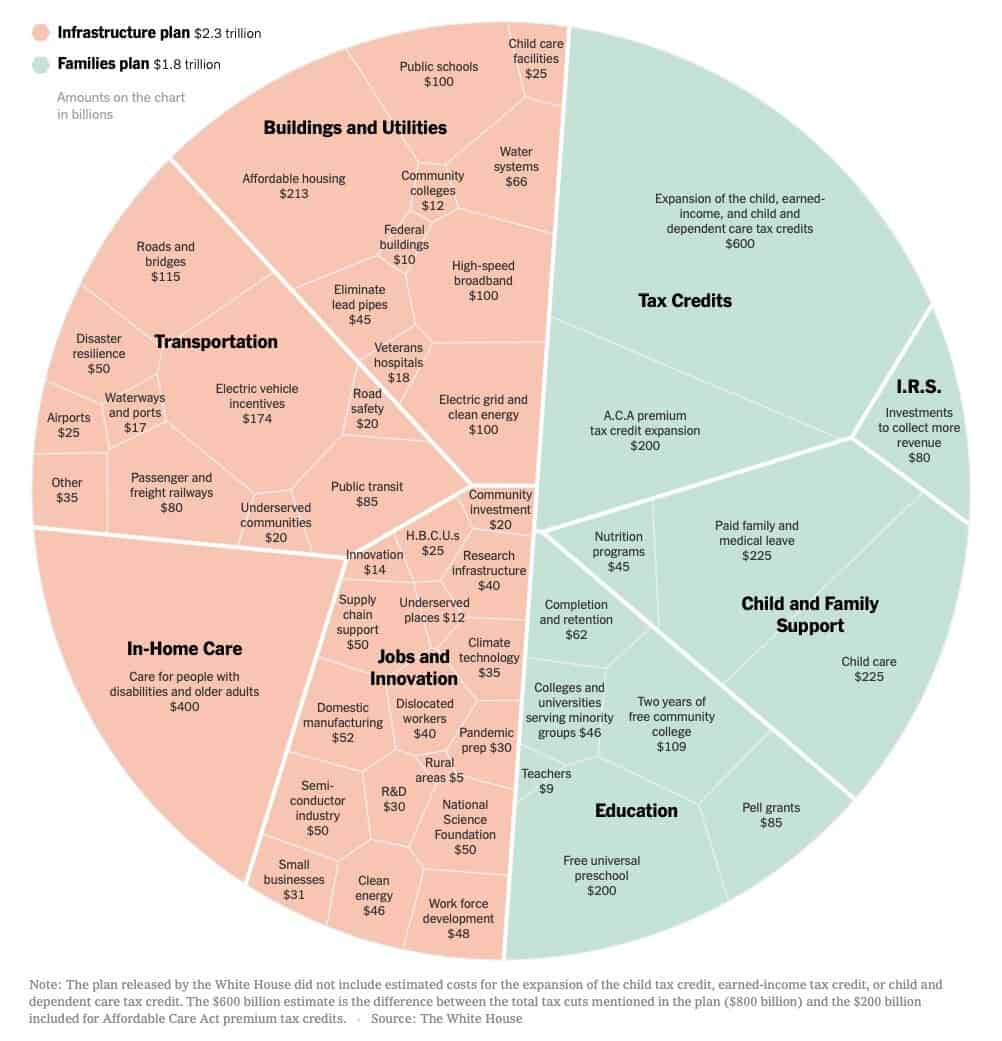

Of course, sometimes that pocket money can seem like too little. How are you going to retire and achieve financial freedom if you only save 50 bucks per month? If you want to know how to save even more, check out today’s infographic.