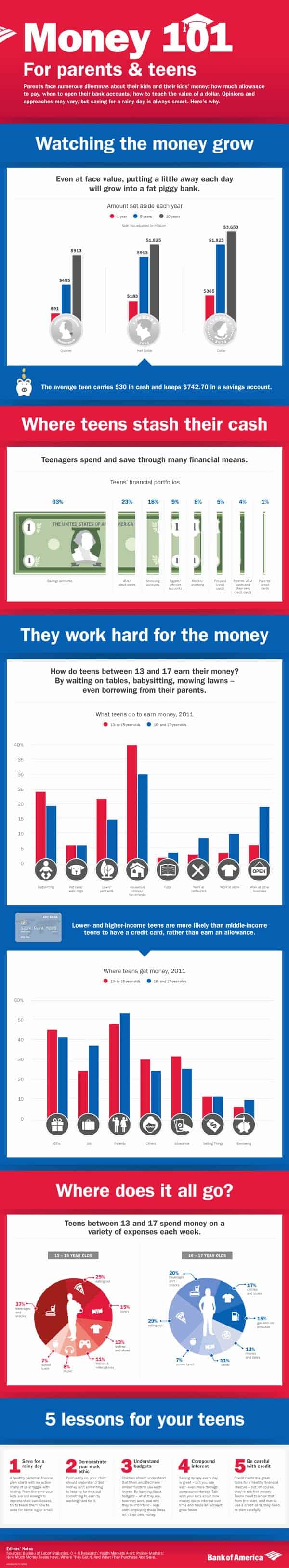

I know I’ve ranted about this subject before, but in my opinion financial management education is one of the most important learning experiences for teenagers. “Money doesn’t grow on trees!” I was always told, and I took it to heart. I very rarely spent birthday or holiday money on things I wanted. I put it in the bank and saved. Of course now in college I’ve spent a ton of my savings, but all those times putting money away has made my current financial situation a little above average.

I always had parents who taught me the importance of personal finance coupled with teachers who would go out of their way and introduce financial management lessons into an english or science class. They know that kids need to know how to take care of their money, and to my benefit they sacrificed valuable class time to teach us.

Today’s graphic shows the many ways teens acquire money, one of the most popular being chores. I never got paid to do chores, or yard work. It was always “for the good of the family”. I got a job as soon as I turned 16 and nothing felt better than getting my own paycheck. Still doesn’t. Money management for teens can be challenging, but Bank of America lends a hand with a Money 101 guide on teenager saving and spending. [Bank of America]